RICS and Ulster Bank Residential Market Survey – May 2022

The imbalance of supply and demand, a pattern very familiar to the residential housing market in Northern Ireland, continued into the fifth month of the year according to the latest RICS (Royal Institution of Chartered Surveyors) and Ulster Bank Residential Market Survey.

A net balance of +8% of respondents reported an increase in new buyer enquiries in the May survey, whilst the net balance of respondents (-25%) reported a fall in new instructions to sell, indicating that there is not sufficient stock coming onto the market for the increased number of new buyers.

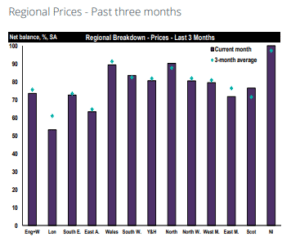

With the imbalance of supply and demand, this is keeping prices moving upwards in the market, with a net balance of +46% of respondents expecting prices to rise over the next three months. This pattern of firm price inflation can be seen throughout most the UK.

In terms of sales, there is optimism in the market, with a net balance of +13% of respondents reporting an increase in sales in the month of May. Looking forward, a net balance of +15% of respondents expect a rise in sales over the next three months.

Longer-term, whilst NI surveyors expect both prices and sales to be higher in a year’s time, there has been some softening in the data. The net balance for 12-month price expectations is now +73% compared to +94% in the last survey.

Samuel Dickey, RICS Northern Ireland Residential Property Spokesman, says: “Demand is still outstripping supply, a pattern that we’ve seen for many months now. In saying that, more vendors do seem to be coming to the market, and it’s encouraging to see surveyors expecting a rise in sales. More stock will assist in addressing the persistent issue of limited supply for prospective buyers. This limited stock has been maintaining strong house prices across all categories.”

Terry Robb, Head of Personal Banking at Ulster Bank, added: “Despite the pressures of the cost-of-living crisis and higher interest rates, the residential market continues to see modestly positive trends in new buyer enquiries. At Ulster Bank we are eager to help our customers save where they can and our green mortgage is one way that we can help consumers save money by being more energy efficient. We want to help our customers understand and reduce their climate impact and deal with the escalating costs of energy bills. We’ve put climate change at the heart of our strategy to be a purpose-led bank here at Ulster Bank so it’s important that we support our customers on the transition to net zero. “