RICS and Ulster Bank Residential Market Survey – October 2021

House prices are continuing to rise in Northern Ireland as fewer properties are listed for sale, according to the October 2021 RICS and Ulster Bank Residential Market Survey.

The balance of NI respondents to the survey said that the number of properties being listed for sale fell in the month, adding to already existing issues with supply. October is the fourth month in succession that respondents (a net balance of -35%) reported a fall in new instructions.

Whilst the outlook points to sales activity stabilising in the coming months, in October, respondents to the survey pointed to another dip in the volume of sales agreed over the month (a net balance of -11%), with respondents feeding back that a lack of stock for would-be buyers to choose from is an issue. This is the second in succession that newly agreed sales are reported to have fallen.

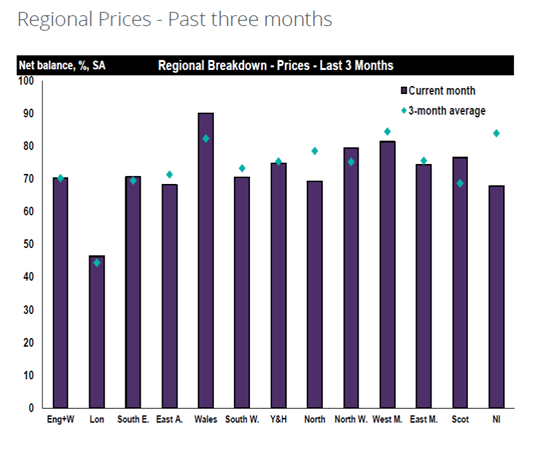

It’s not just the sales activity that is being affected by the lack of stock, but it is a significant factor behind current house price rises. In October, a net balance of +68% of NI respondents cited a rise in house prices, with the pace of growth in line with that seen in the UK as a whole. Again, respondent comments point to the lack of stock on agents’ books as the key factor.

Samuel Dickey, RICS Northern Ireland Residential Property Spokesman, says: “Anecdotal feedback from surveyors is that the lack of stock on their books is both pushing up prices and limiting sales activity. This has been an issue for some time, but it seems to be intensifying and there is little sign that it will improve in the near future. Agents will be hoping that the new year will bring a new impetus from potential sellers to list their properties for sale and help boost sales activity and alleviate some of the price pressures.”

Terry Robb, Head of Personal Banking at Ulster Bank, said: “October was the first month of the final quarter of the year but whilst it was a new quarter some of the main trends in the market continue. In our experience there continues to be good demand but there also continues to be a lack of homes available to buy. But for those moving ahead with a purchase there are a wide range of mortgage options, and with COP26 happening this month, we have seen a further increase in interest for our green mortgage and green remortgage as climate change is front and central in many people’s minds.”