With less choice for buyers in the Northern Ireland housing market, there were fewer newly agreed sales during September, according to the latest RICS and Ulster Bank Residential Market Survey.

The balance of respondents to the survey said that the number of properties being listed for sale fell in the month, adding to already existing issues with supply. As a result, the number of homes being agreed for sale also reduced. This was the first negative balance reported for newly agreed sales since June 2020, albeit marginally so (a net balance of -7% of respondents).

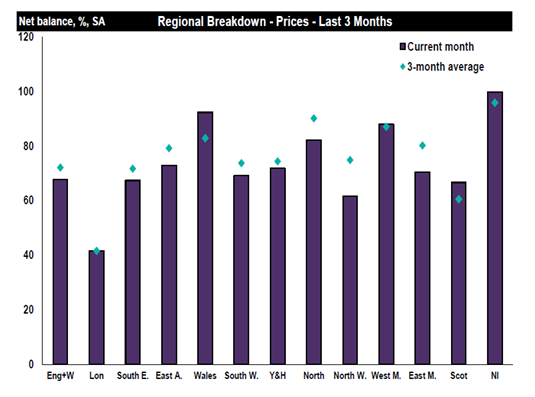

With supply constrained, prices continued to move upwards, according to surveyors. Indeed, respondents were universal in the latest survey in saying that they experienced rising prices (a net balance of 100% of respondents). And their expectations are that prices will continue to increase over the next three months. In terms of sales, despite the lack of supply, surveyors expect these to be up marginally in the next three-month period.

Samuel Dickey, RICS Northern Ireland Residential Property Spokesman, says: “The imbalance between demand and supply remains the most striking feature of the latest RICS and Ulster Bank survey. And feedback from members provides little reason to believe this issue will be resolved anytime soon. The market continues to move from a very abnormal period during Covid. We would expect demand to ease back from the incredibly high levels earlier in the year to more normal levels, but the challenge is that there isn’t the supply to meet even reduced demand and this is continuing to push up prices.”

Terry Robb, Head of Personal Banking at Ulster Bank, said: “September brought to an end the third quarter of the year. And in our experience it was overall another very busy quarter for mortgage demand following on from very strong demand in the previous two quarters. Our buy to let mortgage has been particularly popular. We also introduced our Green mortgage and our 95% mortgage earlier in the third quarter, and we have added a Green Re-mortgage which offers a preferential interest rate to new or existing customers who are looking to re-mortgage an energy efficient property. We want to act as a catalyst in supporting the reduction of the carbon footprint from residential properties.”