Danske Bank expects the pace of economic growth in Northern Ireland to slow from the second quarter of this year onwards as consumer spending is squeezed by high inflation.

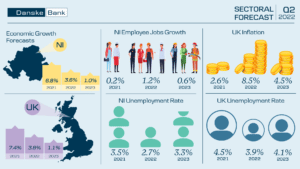

In its latest Northern Ireland Quarterly Sectoral Forecasts report, Danske Bank held its forecast for economic growth steady at 3.6% for 2022 but lowered its growth forecast for 2023 to 1%, down from its previous projection of 1.7%.

The Bank noted that in addition to inflationary pressures, the economic policy environment is also less supportive of growth and uncertainty levels are particularly elevated.

Danske Bank Chief Economist, Conor Lambe, said:

“The Northern Ireland economy is estimated to have grown again in the first quarter of 2022 but we expect the pace of growth from quarter two onwards to be slower as the squeeze on household incomes intensifies given the high rate of inflation. These inflationary pressures are likely to weigh on growth throughout the remainder of 2022 and into 2023.”

“Our forecast for the annual rate of economic growth in 2022 is unchanged from our last report at 3.6% though it is important to note that this projection still reflects an element of the recovery from the coronavirus pandemic. However, our growth forecast for 2023 has been revised downwards.”

Danske Bank expects the rate of price rises to increase further and is forecasting that inflation will average around 8.5% in 2022 and 4.5% in 2023.

SECTOR OUTLOOK

Danske Bank expects the accommodation & food services (16.1%) and arts, entertainment & recreation (10.3%) sectors to experience the fastest growth rates in 2022, reflecting the relatively low annual starting levels in 2021 resulting from the pandemic. But the rate of expansion in these sectors is expected to slow next year as the post-pandemic rebound effects are likely to have faded and high inflation weighs on consumer spending.

Output in the wholesale & retail trade sector is also expected to be held back by the squeeze on household purchasing power, supply chain disruption and lower consumer confidence, with output forecast to rise by around 3.2% in 2022 but only 0.2% in 2023.

The manufacturing sector is projected to slightly lag the overall economy in 2022, with activity levels projected to rise by 3.1%. Inflationary pressures on raw materials, energy and wages as well as ongoing supply chain issues are expected to negatively impact the sector, and will also likely affect the construction industry, which is forecast to see a rise in output of about 3.8% this year.

The information & communication (5.4%) and professional, scientific & technical services (4.8%) sectors are expected to grow faster than the overall economy in 2022, with output growth in 2023 forecast at 2.1% and 2.3% respectively.

LABOUR MARKET OUTLOOK

Danske Bank said the local labour market remains relatively strong with demand for workers remaining firm. The Bank expects that the annual average number of employee jobs will increase by around 1.2% in 2022, with a slower pace of jobs growth of around 0.6% projected for 2023.

Danske Bank is also forecasting that the unemployment rate in Northern Ireland will average around 2.7% in 2022 and 3.3% in 2023.

The arts, entertainment & recreation sector is expected to see the largest percentage rise in employee jobs in 2022, growing by 3.5%, while the annual average number of employee jobs in the accommodation & food services sector is forecast to grow by 2.2% this year, before easing to 0.6% in 2023.

The construction sector is expected to experience a 2.2% increase in employment in 2022, but the manufacturing sector is forecast to see only a 0.4% rise in the number of employee jobs this year before a decline in 2023 as skills shortages and longer-term trends towards increased automation reduce employment levels in the sector.

The information & communication sector is forecast to experience jobs growth of around 2.5% in 2022, while jobs in the administrative & support services sector are tipped to increase by 1.8% and employment in the professional, scientific & technical services sector is projected to increase by 0.9%. The pace of jobs growth in the latter two sectors is forecast to accelerate next year.

RISKS AND UNCERTAINTIES

While there is always uncertainty around economic forecasts, Danske Bank said the extent of the risks and uncertainties around its latest projections is considered to be more elevated than normal.

Conor Lambe said:

“Inflation in the UK is at a multi-decade high and we expect it to rise even further before the end of this year. If inflation runs higher than forecast and remains at more elevated levels for a longer period of time, it has the potential to constrain economic growth even further.

“This could occur if fuel and energy prices remain higher for longer, supply chains take longer to normalise or if the current tightness of the labour market begins to result in more domestically driven inflation, with a wage-price spiral keeping the rate of price rises above its target rate.

“Higher and more prolonged inflation could also mean that Bank Rate would be increased at a faster pace to contain the rate of price rises and that could further dampen economic activity. Persistent supply chain disruption could also adversely impact activity levels in goods-based businesses if they are unable to source the products they sell or use as inputs.”