Today sees the release of April data from the Ulster Bank Northern Ireland PMI®. The latest report – produced for Ulster Bank by S&P Global – indicated that growth was sustained in the Northern Ireland private sector, with activity up for the third month running. Employment continued to rise markedly as a result. Meanwhile, rates of both input cost and output price inflation softened again and suppliers’ delivery times shortened.

Commenting on the latest survey findings, Richard Ramsey, Chief Economist Northern Ireland, Ulster Bank, said:

“Northern Ireland’s private sector started the second quarter in the same way that it ended the first with businesses in expansion mode. Output, orders and employment all increased in April albeit the pace of growth eased relative to March. This was particularly marked with new orders as falling demand amongst manufacturers and construction firms largely offset growth within retail and services. Manufacturing was the only sector to post a decline in output in April with construction finally recording a rise in activity for the first time in 14 months.

“The trend of easing inflationary pressures continued last month with input costs rising at the weakest pace in almost two-and-a-half years. Services firms have recorded the steepest rise in cost pressures in each of the last five months. Despite robust rates of wage inflation, all sectors continued to increase their staffing levels in April. Retailers led the way in the recruitment drive, but construction firms posted a record rise in staffing levels. This would appear to suggest the softer demand in the sector is enabling longstanding vacancies to finally be filled.

“Supply chain disruption has blighted the economy since the pandemic first hit. But April’s survey revealed that firms saw supplier delivery times shorten for the first time since the question was introduced back in March 2021.

“Overall, the steady improvement in the private sector is in stark contrast with the mounting difficulties within the public sector. Budget cuts and a scaling back of public services will also have implications for parts of the private sector too. Meanwhile the headwinds of higher interest rates and increased taxation will increasingly be felt by all parts of the economy in the year ahead.”

The main findings of the April survey were as follows:

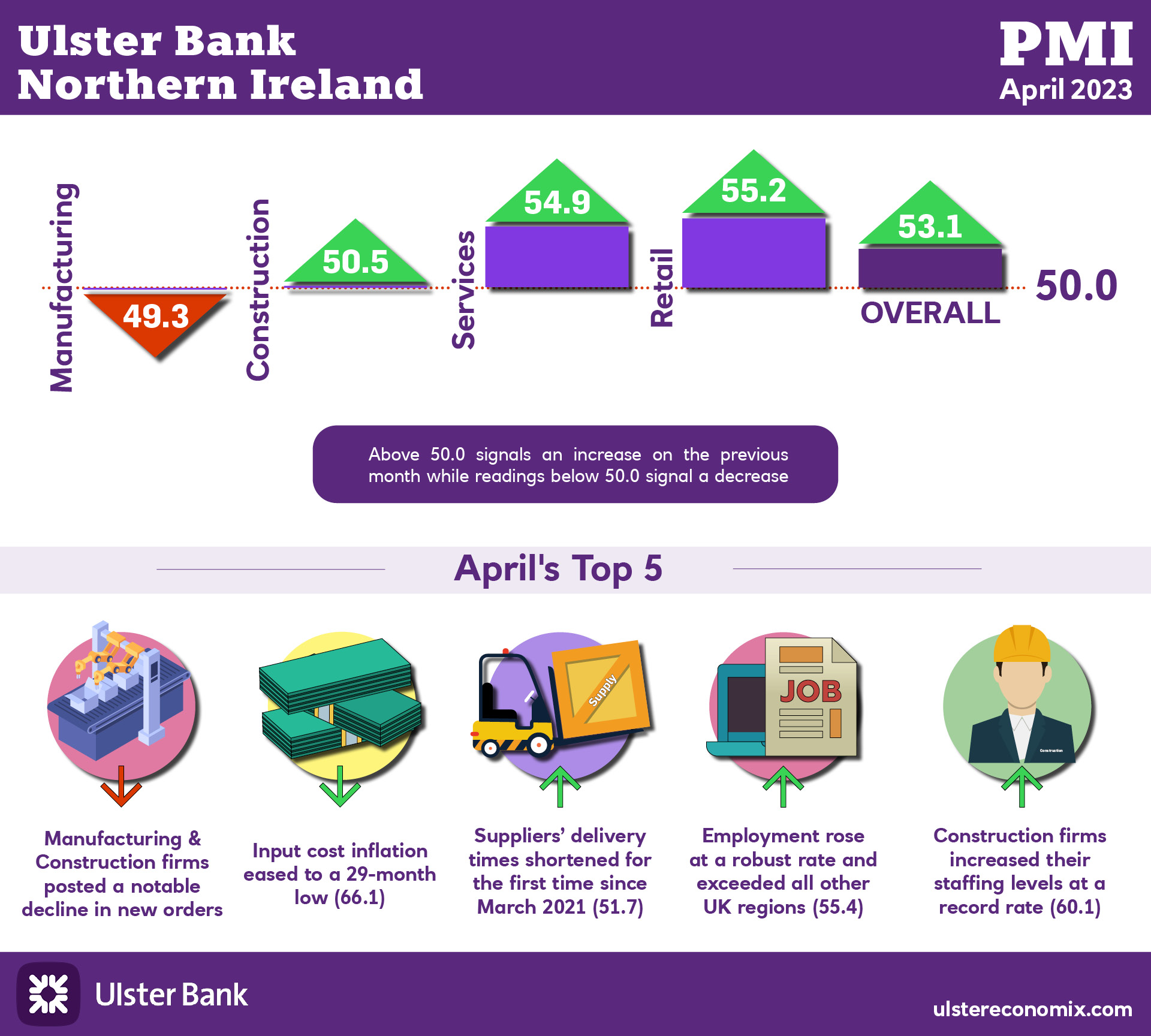

The headline seasonally adjusted Business Activity Index posted 53.1 in April, down from 54.9 in March but still signalling a solid monthly increase in business activity at companies in Northern Ireland. Output has now risen in three successive months. Activity increased in the services, construction and retail sectors, but dipped in manufacturing. Output growth was often linked to higher new orders, which also increased for the third month running. That said, the rate of expansion eased and was only marginal.

Rising new orders also encouraged firms to expand employment again, with some companies increasing staffing levels to try and work through outstanding business. Staffing levels continued to rise sharply. While higher wages and energy prices continued to push up input costs in April, the rate of inflation softened for the seventh consecutive month and was the weakest in close to two-and-a-half years. Similarly, the pace of increase in selling prices was the least pronounced since December 2020. For the first time since the question on suppliers’ delivery times was added to the survey in March 2021, vendor performance improved in April. Companies remained optimistic that output will continue to rise over the coming year, with confidence supported by improvements in new orders.